Why is your credit score important? This is a great question, your credit score does not only determine the type of home mortgage loan you can qualify for, but it also impacts the new credit lines (credit cards, auto loans, etc.) that you can qualify for, your rental application and auto insurance.

The 3 credit buraus are Experian, Equifax, and TransUnion. Your credit score is determined by your payment history, length, or time you have had your credit accounts, the credit mix or different type of accounts in your credit (revolving and installment accounts, mortgage and auto loans, collections, liens, public records), how much you owe overall, and if you have applied for new credit.

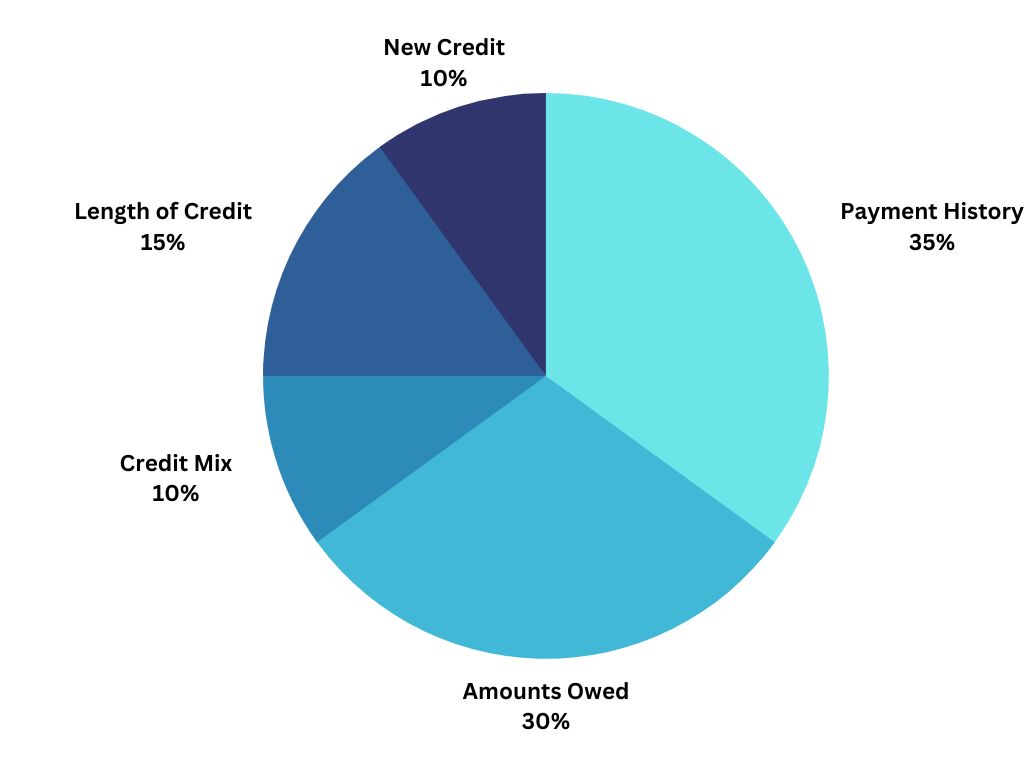

Here is a helpful chart we’ll analyze through this episode.

Payment History

On time or late payments make the biggest impact on your credit score. Paying your credit cards, car loans, student loans, installment accounts, solar panels, or any other account on time or before the due date is very important as it accounts for 35% of your credit score. Making on time payment will continue to boost your credit score and show the credit bureaus that you are a responsible account holder. If you forget to make a payment on time, we highly recommend you contact the creditor to remove the late payment, they usually can do this as a courtesy if you have a good history with them.

Amounts Owed

The balance in your credit cards account for up to 30% of your credit score. It is recommended that you keep your account balances at 30% or less of your credit limit, in other words, don’t max them out. If you use up your credit card up to the limit, make sure to pay down the balance to 30% or less by the due date so it doesn’t ding your credit score. You can get extra points in your credit score by lowering the balance from 0% to 10% of the limit.

Length of Credit

Credit history accounts for 15% of your credit score, the longer your accounts are open and in good standing the better your credit score as it shows a long-standing relationship with creditors. TIP: If you have a parent with a great credit history, you may want to ask them to add you as an authorized user to their account to piggy-back from their established accounts.

Credit Mix

Having different type of accounts in your credit can also give you a boost on your credit score. For example, having one to two revolving credit cards, one installment account such as car loan or student loan or small personal loan as well as a mortgage loan will give your credit score a boost.

New Credit

Opening new credit accounts can also boost your credit, our recommendation is to only open as many accounts you can handle or keep track of the last thing you want is to open an account and forget to pay it.

Are you working on increasing your credit score? Or perhaps tackle on some debt? Let us know if we can help, we have some wonderful partners that can help you get your finances in order.

Leave A Comment