Is it a buyer or sellers’ market?

This is a very common question, in this video we breakdown how the Las Vegas market is reacting to the higher interest rates, increase of home inventory and the importance of having a good team behind you. We’ll cover information about buydown loan programs, the benefit of working with an agent that understands how to run the ‘comps’ – accurate home value based on recent sales in a specific area and similar properties – and how best to negotiate on our clients’ behalf.

The most important take away, only buy a home that you can afford.

Rigo Garcia from EXP Realty joins us today, Rigo and I have been working together for the last 6 years.

How does supply (available homes for sale) and demand (approved buyers) affect home prices?

In early 2022 interest rates were historically low which meant more buyers were able to qualify for a mortgage loan resulting in a lot of buyer competition. Most buyers had to submit anywhere from 10 to 30 offers before getting their offers accepted and sometimes pay more than what the house was worth. Properties were selling the same-day at higher than list price meaning sellers were getting a great deal.

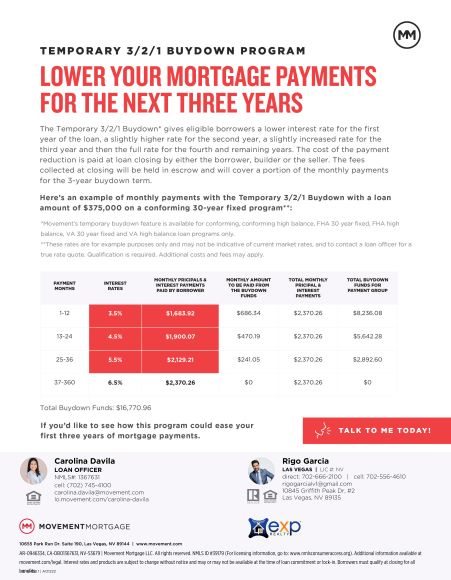

Since approximately October 2022, interest rates have gone up which has resulted in less qualified buyers giving new approved buyers the opportunity to have a lot more home options when submitting offers. We are seeing many motivated sellers offering incentives towards the buyer’s closing costs, discount points and buydown programs.

Is it a good time to buy, to sell or invest?

It all depends on each client’s scenario.

Buyers: If you are looking to occupy the property, it is a good time to buy today due to increase in home inventory, down payment assistance programs available, seller incentives and knowing that market rents have increased and your mortgage payment could likely be the same as if you were renting. Buying is allowing you to invest in real estate by simply living in your home.

The example below shows how to use seller incentives towards buydown programs.

If a buyer doesn’t have funds to use towards a down payment, there are down payment assistance programs to cover part or the entire down payment, the main requirements are:

- Minimum credit score of 640, 660 opens more options

- Debt to income ratio of 45% – new monthly payment + debt / gross monthly income

- Occupy the home as your primary residence

- Some programs have income requirements, ideally the applicant’s income will be under $98,000/year

- Some programs have area requirements, rural programs are available for up to 100% financing

Sellers: Depending on each situation, we can examine whether it would be a good time to sell or not. For example if a seller has gained $100,000 in equity by just living in their home and need $80,000 to buy a new home, perhaps giving $10,000 to $20,000 in seller concessions would help their home sell fast which turns into a smooth transition to their new home. Sellers today benefit from having underwritten approved buyers that have gone through the entire loan process approval to make sure they can qualify with the higher rates which means an easy and smooth transaction.

Investors: Cash investors can benefit from the lower home prices and higher market rents. If they have liquid assets, they can safely invest them in real estate knowing that the overhead will be small and the monthly returns can be high. People still need a place to live.

The bottom line, let us look at your situation, analyze your assets, properties and financial goals to make an educated decision.

Some Great Partner Resources: Handyman, General Contractor, Insurance Agent, Financial Advisor, Tax Preparer, Electrician.

Looking for a specific trade? Send us a message here!

Leave A Comment